Wednesday, October 22, 2014

Our blog has moved!

The launch of www.NeighborWorks.org allowed us to integrate our blog into the organization's main public website. We renamed the blog IdeaWorks and gave it a new look!

Check it out at NeighborWorks.org/Blog. Sign up there (righthand margin) to receive new entries in your email inbox.

Thursday, July 31, 2014

Neighborhood marketing: Success is what you measure

By Pam Bailey, NeighborWorks America blogger

This is the third and final post in a series exploring neighborhood marketing as a strategy for helping communities brand and generate attention for their unique strengths. Read the first and second installments. Neighborhood marketing is not an initiative for those who only have the time or commitment for a short-term program.

“What we’re after is real change – whether it be strengthened connections among residents, rising property values, thriving neighborhood businesses, or a better mix of renters and owners,” explains Paul Singh, senior manager of community stabilization for NeighborWorks America, adding that part of the challenge is defining just what success looks like. “It takes time. That’s why interim measures are so important.”

John Groene, neighborhood director of the West Humboldt Park office of Neighborhood Housing Services of Chicago, has fully embraced that concept. The marketing plan his organization adopted in 2013 for West Humboldt Park includes 23 phases being rolled out over five years.

However, although he estimates only 10 percent of the plan has been implemented to date, West Humboldt Park already has some successes to celebrate. NHS has recently assisted three families, all long-term renters in the community (two for more than 20 years) buy and rehab long-vacant properties. Even better, the daughter of one of those buyers just signed a purchase contract for a vacant three-unit building just a block away from the home her mother purchased through NHS.

Likewise, in a neighborhood that for a long time had no sit-down restaurants, two establishments have become city favorites, with a friendly competition to determine who has the best “jive turkey burger.” (A recent study by an urban planner found that restaurants are the leading force behind regenerating coup de grace was its ranking this

year by the Redfin real estate site, which neighborhoods.) But the produces an annual list of the country’s “hottest” neighborhoods. The company ranked 105 urban neighborhoods across 21 major markets that have grown the most in popularity during the four months leading into 2014. Humboldt Park was No. 10. Although “hot” markets can bring their own challenges (for example, how to preserve affordability for existing residents), the Redfin ranking suggests that West Humboldt Park is increasingly seen as a desirable neighborhood.

NeighborWorks Pocatello (Idaho) is just starting its neighborhood marketing campaign, but Executive Director Mark Dahlquist knows that one of his first interim metrics must be the number of households that invest in beautifying their property, thus enhancing their “curb appeal.”

“We already give lots of home improvement loans, but now we are looking for funding so we can offer a small grant, or maybe a zero-interest loan, specifically for external enhancements,” he says. “Maybe we’ll also offer a workshop to show people all the ways they can make their houses a little less plain, or sponsor a contest.”

Dahlquist also estimates there are about 40 houses in the Old Town of Pocatello currently for sale. His goal is to keep out absentee owners.

“We don’t have a lot of vacant lots, but we do have some empty or unkempt properties that are either bank-owned or have absentee landlords,” he explained, adding that housing values in Old Town are about 30 percent lower than elsewhere in the city. “We’ve invested in our city’s central neighborhoods by building more than 135 new homes in the past 20 years. You can live in a charming house, but if you’re located next to something that is in poor condition, values drop. We need to push them up.”

Whatever a community’s reasons for needing to change perceptions, or how far long they are, the process of adopting a philosophy of neighborhood marketing can, both Dahlquist and Groene agree, offer an entirely new perspective.

“Neighborhood marketing broadens how you look at revitalization,” says Groene. “It forces you to really think about why people like living in a particular place. It has changed the way I speak to everyone. I talk about the good things going on in the whole neighborhood every time I go to block clubs, etc. It’s not just, hey, want to buy a home, or the most pressing problems of the day.”

NeighborWorks America will continue to document and share best practices that emerge from the Neighborhood Marketing Program. Resources, tools and templates are available that can assist with your own neighborhood marketing efforts.

This is the third and final post in a series exploring neighborhood marketing as a strategy for helping communities brand and generate attention for their unique strengths. Read the first and second installments. Neighborhood marketing is not an initiative for those who only have the time or commitment for a short-term program.

“What we’re after is real change – whether it be strengthened connections among residents, rising property values, thriving neighborhood businesses, or a better mix of renters and owners,” explains Paul Singh, senior manager of community stabilization for NeighborWorks America, adding that part of the challenge is defining just what success looks like. “It takes time. That’s why interim measures are so important.”

|

| One of the "hot" restaurants that has popped up in West Humboldt Park. |

However, although he estimates only 10 percent of the plan has been implemented to date, West Humboldt Park already has some successes to celebrate. NHS has recently assisted three families, all long-term renters in the community (two for more than 20 years) buy and rehab long-vacant properties. Even better, the daughter of one of those buyers just signed a purchase contract for a vacant three-unit building just a block away from the home her mother purchased through NHS.

Likewise, in a neighborhood that for a long time had no sit-down restaurants, two establishments have become city favorites, with a friendly competition to determine who has the best “jive turkey burger.” (A recent study by an urban planner found that restaurants are the leading force behind regenerating coup de grace was its ranking this

year by the Redfin real estate site, which neighborhoods.) But the produces an annual list of the country’s “hottest” neighborhoods. The company ranked 105 urban neighborhoods across 21 major markets that have grown the most in popularity during the four months leading into 2014. Humboldt Park was No. 10. Although “hot” markets can bring their own challenges (for example, how to preserve affordability for existing residents), the Redfin ranking suggests that West Humboldt Park is increasingly seen as a desirable neighborhood.

NeighborWorks Pocatello (Idaho) is just starting its neighborhood marketing campaign, but Executive Director Mark Dahlquist knows that one of his first interim metrics must be the number of households that invest in beautifying their property, thus enhancing their “curb appeal.”

“We already give lots of home improvement loans, but now we are looking for funding so we can offer a small grant, or maybe a zero-interest loan, specifically for external enhancements,” he says. “Maybe we’ll also offer a workshop to show people all the ways they can make their houses a little less plain, or sponsor a contest.”

Dahlquist also estimates there are about 40 houses in the Old Town of Pocatello currently for sale. His goal is to keep out absentee owners.

“We don’t have a lot of vacant lots, but we do have some empty or unkempt properties that are either bank-owned or have absentee landlords,” he explained, adding that housing values in Old Town are about 30 percent lower than elsewhere in the city. “We’ve invested in our city’s central neighborhoods by building more than 135 new homes in the past 20 years. You can live in a charming house, but if you’re located next to something that is in poor condition, values drop. We need to push them up.”

Whatever a community’s reasons for needing to change perceptions, or how far long they are, the process of adopting a philosophy of neighborhood marketing can, both Dahlquist and Groene agree, offer an entirely new perspective.

“Neighborhood marketing broadens how you look at revitalization,” says Groene. “It forces you to really think about why people like living in a particular place. It has changed the way I speak to everyone. I talk about the good things going on in the whole neighborhood every time I go to block clubs, etc. It’s not just, hey, want to buy a home, or the most pressing problems of the day.”

NeighborWorks America will continue to document and share best practices that emerge from the Neighborhood Marketing Program. Resources, tools and templates are available that can assist with your own neighborhood marketing efforts.

Wednesday, July 30, 2014

Neighborhood marketing: Is the time right for an ‘inside’ or ‘outside’ game?

By Pam Bailey, NeighborWorks America blogger

This is the second post in a three-part series exploring neighborhood marketing as a strategy for helping communities brand and generate attention for their unique strengths. Read the first installment.

A critical question that must be asked before embarking on a neighborhood marketing campaign is whether the community is ready for “prime time,” or needs to focus internally first.

“You need some early wins to bring about a mind shift among existing residents and stakeholders before you can market externally,” explains Paul Singh, senior manager for community stabilization at NeighborWorks America. “A neighborhood brand is a statement about who lives and works there and why. In order for the brand to be believable, residents must perceive that they made a good investment and have confidence in the future.”

Marcia Nedland, a neighborhood branding expert who Singh’s team assigns as support to some of its program participants, agrees.

“Usually, there is a gap between what organizations would like the world to think and their ability to deliver, and there is typically a lot of work required to close that gap,” Nedland says.

NeighborWorks Pocatello in Idaho is among the 17 network members accepted into the marketing program this month. The organization’s participation in NeighborWorks America’s new Community Impact Measurement project allowed it to demonstrate that it is indeed ready for the “outside game.”

“The survey that was part of the project surprised even us,” says Mark Dahlquist, executive director. “It showed that 85 percent of residents living in the Old Town area are satisfied with living there. Elsewhere in the city, Old Town is looked at as a less-desirable place, but now we have the data to tell a different story.”

Old Town Pocatello has a lot of assets residents love: It’s centrally located, is characterized by architecturally interesting homes with front porches that encourage engagement, and residents regularly connect with each other through a farmers market and “Revive at 5” concerts.

Historically, however, crime was a problem in Old Town, and that reputation has persisted. “We need to reach out to the media and to others and show them Old Town today,” says Dahlquist.

Resident Buy-In and Ownership

Another lesson learned from the first round of participants in the Neighborhood Marketing Program is how critical it is to obtain strong engagement by residents and other stakeholders – before the campaign launch and throughout implementation.

“Residents and businesses must ultimately own the brand; organizations can only be early drivers,” explains Singh. “We recommend that each participant form a branding and marketing team that includes businesses, residents and local institutions. The team can help shape the brand, educate other community members on ways to promote positive messages and assist in implementing specific marketing tactics.”

John Groene, neighborhood director of the West Humboldt Park office of Neighborhood Housing Services of Chicago, says his organization talked to local residents about what the community was like in the 1960s and ‘70s. He heard about the diversity of walkable stores – from bakeries to flower shops – and the friendliness of goods displayed on the sidewalk, inviting conversation. “It helped us create a shared vision of what the neighborhood could be again,” he says.

Dahlquist’s organization in Pocatello faces a special challenge. “The Old Town area is really five different neighborhoods, each with different dynamics,” he explains, adding that Neighborhood Pocatello will likely subdivide it into five sections, with one brand but different grassroots teams. “A cookie-cutter approach won’t work.”

The final post in this series on neighborhood marketing will look at how to measure success.

This is the second post in a three-part series exploring neighborhood marketing as a strategy for helping communities brand and generate attention for their unique strengths. Read the first installment.

A critical question that must be asked before embarking on a neighborhood marketing campaign is whether the community is ready for “prime time,” or needs to focus internally first.

|

| Neighborhood marketing enlists residents in promotion of their community |

Marcia Nedland, a neighborhood branding expert who Singh’s team assigns as support to some of its program participants, agrees.

“Usually, there is a gap between what organizations would like the world to think and their ability to deliver, and there is typically a lot of work required to close that gap,” Nedland says.

NeighborWorks Pocatello in Idaho is among the 17 network members accepted into the marketing program this month. The organization’s participation in NeighborWorks America’s new Community Impact Measurement project allowed it to demonstrate that it is indeed ready for the “outside game.”

“The survey that was part of the project surprised even us,” says Mark Dahlquist, executive director. “It showed that 85 percent of residents living in the Old Town area are satisfied with living there. Elsewhere in the city, Old Town is looked at as a less-desirable place, but now we have the data to tell a different story.”

|

| "Revive at 5" festival in Old Town, Pocatello |

Historically, however, crime was a problem in Old Town, and that reputation has persisted. “We need to reach out to the media and to others and show them Old Town today,” says Dahlquist.

Resident Buy-In and Ownership

Another lesson learned from the first round of participants in the Neighborhood Marketing Program is how critical it is to obtain strong engagement by residents and other stakeholders – before the campaign launch and throughout implementation.

“Residents and businesses must ultimately own the brand; organizations can only be early drivers,” explains Singh. “We recommend that each participant form a branding and marketing team that includes businesses, residents and local institutions. The team can help shape the brand, educate other community members on ways to promote positive messages and assist in implementing specific marketing tactics.”

John Groene, neighborhood director of the West Humboldt Park office of Neighborhood Housing Services of Chicago, says his organization talked to local residents about what the community was like in the 1960s and ‘70s. He heard about the diversity of walkable stores – from bakeries to flower shops – and the friendliness of goods displayed on the sidewalk, inviting conversation. “It helped us create a shared vision of what the neighborhood could be again,” he says.

Dahlquist’s organization in Pocatello faces a special challenge. “The Old Town area is really five different neighborhoods, each with different dynamics,” he explains, adding that Neighborhood Pocatello will likely subdivide it into five sections, with one brand but different grassroots teams. “A cookie-cutter approach won’t work.”

The final post in this series on neighborhood marketing will look at how to measure success.

Tuesday, July 29, 2014

Neighborhood marketing: ‘spin’ or substance?

By Pam Bailey, NeighborWorks America blogger

“Your brand is what people say about you when you are not around” -- North Star Ideas, neighborhood marketing program consultant

The term “marketing” usually conjures images of prescription drug ads with disclaimers in fine print, or smooth-talking car salesmen. But when informed by customer research and practiced effectively, branding and other marketing tactics can match services and products to the people who most need or want them. Can the same approach be applied to a neighborhood that is struggling to counteract negative perceptions or differentiate itself from others?

NeighborWorks America believes the answer is “yes.” The team with the Stable Communities Initiative at NeighborWorks first began piloting the idea with two network organizations that were working hard to turn around their communities around by acquiring, rehabbing and selling vacant, foreclosed houses. They had run up against a challenge, however: How do you lure new homeowners, or businesses for that matter, when the perception of high foreclosures, blight or crime overshadows the progress?

From that early experience, the Neighborhood Marketing Program was born. It is designed to pioneer and promote new ways of using marketing techniques to stabilize and revitalize communities.

“NeighborWorks America began focusing on community stabilization in 2007, in direct response to the foreclosure crisis,” recalls Ascala Sisk, director of community stabilization. “Our primary focus was on stemming the damage that foreclosures were wreaking on neighborhoods. As a result, much of our work was on helping member organizations gain control of and re-sell foreclosed homes. However, we know that to really stabilize and ultimately revitalize a community, it takes more than housing development. It takes a broader, holistic 'place-based' approach."

In 2012, NeighborWorks America selected the first 16 participants in its Neighborhood Marketing Program, offering each participant consultation with a branding expert, professional assistance with logo creation and other promotional materials, an implementation grant, and opportunities to network and share learnings. The program was extended this month to 17 additional organizations.

The team has learned several lessons in the course of its work with organizations that can help any community-based nonprofit when marketing a particular neighborhood. Paul Singh, senior manager of community stabilization and lead on the Neighborhood Marketing Program, describes four important considerations that organizations should think through before embarking on a such a campaign: 1) What do the trends say? 2) Is the time right for an “inside” or an “outside” game? 3) Do you have resident buy-in and ownership? and 4) What would success look like?

What do the market trends say?

“Any re-positioning of a neighborhood must be grounded in reality,” notes Singh. “There must already be some momentum that can be seen visually. For example, would someone walking down the street feel safe? Are there homes with strong "curb appeal"? Are home prices and vacancies stable? Do residents speak favorably of the neighborhood themselves? There can be some challenges, but the trajectory has to be going in the right direction. Otherwise, you first need to take some other actions to bolster neighborhood strengths and generate positive energy.”

Neighborhood Housing Services (NHS) of Chicago was one of the first-round participants in the marketing program, with a focus on West Humboldt Park. John Groene, neighborhood director of the organization’s West Humboldt Park office, explains that the community had strong assets: It is close to downtown Chicago, is surrounded on three sides by parks, is served by healthcare institutions with regional reputations and has plenty of affordable homes. Several new public services and businesses were moving in, and NHS had already done a fair amount of work to prevent foreclosures and encourage home rehabs through targeted grants and lending. However, the next step was to build more stability in the neighborhood by increasing the number of owner-occupied homes. The “low-hanging fruit,” NHS decided, was to focus on converting renters to buyers, persuading them to stay in West Humboldt Park instead of moving to the suburbs or other cities. Then the organization could expand its appeal its outwards.

“There had been a lot of bad press and internal conversation about crime in the neighborhood,” explains Groene. “Two years ago, for instance, a local newspaper called The Reader ran a story on Humboldt Park headlined ‘Besieged.’ Yes, crime is still a problem; but most of the blocks in the neighborhood are strong. We just need more residents who buy in and get involved. That’s where neighborhood marketing comes in.”

With the help of a branding and marketing strategy, NHS of Chicago is reaching out to this demographic with the message that West Humboldt Park is “an ideal place for new beginnings.”

The next post in this series will explore two other factors important to neighborhood marketing: whether the time is right for an “inside” or “outside” game, and the degree of resident ownership.

“Your brand is what people say about you when you are not around” -- North Star Ideas, neighborhood marketing program consultant

The term “marketing” usually conjures images of prescription drug ads with disclaimers in fine print, or smooth-talking car salesmen. But when informed by customer research and practiced effectively, branding and other marketing tactics can match services and products to the people who most need or want them. Can the same approach be applied to a neighborhood that is struggling to counteract negative perceptions or differentiate itself from others?

From that early experience, the Neighborhood Marketing Program was born. It is designed to pioneer and promote new ways of using marketing techniques to stabilize and revitalize communities.

“NeighborWorks America began focusing on community stabilization in 2007, in direct response to the foreclosure crisis,” recalls Ascala Sisk, director of community stabilization. “Our primary focus was on stemming the damage that foreclosures were wreaking on neighborhoods. As a result, much of our work was on helping member organizations gain control of and re-sell foreclosed homes. However, we know that to really stabilize and ultimately revitalize a community, it takes more than housing development. It takes a broader, holistic 'place-based' approach."

In 2012, NeighborWorks America selected the first 16 participants in its Neighborhood Marketing Program, offering each participant consultation with a branding expert, professional assistance with logo creation and other promotional materials, an implementation grant, and opportunities to network and share learnings. The program was extended this month to 17 additional organizations.

The team has learned several lessons in the course of its work with organizations that can help any community-based nonprofit when marketing a particular neighborhood. Paul Singh, senior manager of community stabilization and lead on the Neighborhood Marketing Program, describes four important considerations that organizations should think through before embarking on a such a campaign: 1) What do the trends say? 2) Is the time right for an “inside” or an “outside” game? 3) Do you have resident buy-in and ownership? and 4) What would success look like?

What do the market trends say?

“Any re-positioning of a neighborhood must be grounded in reality,” notes Singh. “There must already be some momentum that can be seen visually. For example, would someone walking down the street feel safe? Are there homes with strong "curb appeal"? Are home prices and vacancies stable? Do residents speak favorably of the neighborhood themselves? There can be some challenges, but the trajectory has to be going in the right direction. Otherwise, you first need to take some other actions to bolster neighborhood strengths and generate positive energy.”

|

| The new logo developed for West Humboldt Park |

“There had been a lot of bad press and internal conversation about crime in the neighborhood,” explains Groene. “Two years ago, for instance, a local newspaper called The Reader ran a story on Humboldt Park headlined ‘Besieged.’ Yes, crime is still a problem; but most of the blocks in the neighborhood are strong. We just need more residents who buy in and get involved. That’s where neighborhood marketing comes in.”

With the help of a branding and marketing strategy, NHS of Chicago is reaching out to this demographic with the message that West Humboldt Park is “an ideal place for new beginnings.”

The next post in this series will explore two other factors important to neighborhood marketing: whether the time is right for an “inside” or “outside” game, and the degree of resident ownership.

Tuesday, June 24, 2014

Want to be like StoryCorps? Here's expert advice

By Pam Bailey, NeighborWorks America blogger

This is the third post in a three-part series on the power of oral storytelling. Read the first and second posts.

So, you want to try recording your own oral narratives? Here are some tips from two experts to get you started: the StoryCorps team in New York, and Neal Augenstein, a DC-based radio reporter who runs workshops on using the iPhone as a reporting device.

Equipment and software

Interview prep

The interview

If you try out audio storytelling, share your experiences with us!

This is the third post in a three-part series on the power of oral storytelling. Read the first and second posts.

So, you want to try recording your own oral narratives? Here are some tips from two experts to get you started: the StoryCorps team in New York, and Neal Augenstein, a DC-based radio reporter who runs workshops on using the iPhone as a reporting device.

Equipment and software

- You can use a variety of devices to record an audio interview – an actual tape recorder (remember those?), a smart phone or a laptop. (Augenstein recommends either the iPhone or the new Samsung S5.) Whatever you use, practice with it before the interview!

|

| Neal Augenstein |

- Particularly if you’re using a computer or recorder, StoryCorps recommends adding an external microphone (read this handy "how-to" guide) to improve sound quality. Another good add-on is a windscreen, a foam sleeve (available online or at music stores) that slides over the head of a microphone or the bottom of a smart phone to protect against the harsh air sounds.

“The built-in microphone of the iPhone is very susceptible to wind — even a stiff breeze can ruin a recording,” says Augenstein. “ Yet, a simple windscreen has allowed me to use my iPhone during coverage of a hurricane.”

- StoryCorps also recommends wearing a good set of headphones while conducting an interview to allow you to hear how the finished recording will sound – and detect any problems early.

- Augenstein and StoryCorps suggest SoundCloud, a free site like YouTube where you can upload and share audio files. For editing, Augenstein recommends Voddio, which he says “facilitates both down-and-dirty or intricate reports from the field.”

- Bring a camera too! When you post and share your audio clips, they are more visually appealing if you include a photo of your interviewee(s).

Interview prep

|

| A StoryCorps interview in progress |

- Create a list of five to 10 open-ended questions (nothing that can be answered with a yes or no), designed to elicit the “mundane details” that make stories seem real and authentic, as well as feelings. Augenstein suggests beginning with some “throw-away” questions first, such as what he or she likes to do during off hours, to establish rapport and allow your interviewee to become comfortable with being interviewed/recorded. (That is one advantage to audio interviews, however! People are typically have a much harder time relaxing when a video camera is on.)

- Choose a location for the interview. StoryCorps recommends selecting the quietest place possible, ideally a carpeted room with any electronic appliances or devices that could make noise turned off or moved into another room. However, Augenstein recommends recording a minute or so of ambient sound that captures the interviewee’s unique context – whether it be church bells, horns honking or the simple sound of toast popping up. “Audio can create theater of the mind, bringing the listener to the scene,” he explains. “Using sounds effectively helps listeners paint a mental picture.”

The interview

- Augenstein recommends standing while conducting the interview, if possible. “It generally increases your energy,” he explains.

- Remember that your pre-planned questions are only a starting point! You want to have a conversation, and to listen for “golden nuggets”; when you hear them, follow the direction they take you. At the same time, avoid interrupting, even with “uh-huh.” Instead, use visual cues like nodding your head to encourage your storyteller to keep going. Look your interviewee in the eyes and stay engaged. (It’s good to take notes to remember “high points” or follow-up questions, but too much of that and you will lose your connection. The beauty of recording interviews is that it frees you up to converse!)

- But most important of all: Be curious, sincere..and keep an open mind and heart.

If you try out audio storytelling, share your experiences with us!

Monday, June 23, 2014

Using oral histories to bring a city alive

By Pam Bailey, NeighborWorks America blogger

This is the second post in a three-part series on the power of oral storytelling. Read the first post.

HANDS, a NeighborWorks member in Orange, NJ, was an early believer in the power and versatility of the human voice, and has put the medium to a unique use – an oral history “tour” of the community that is helping the old and young alike re-discover why they should love their home town.

“Orange is only 2.2 square miles, but sort of embodies the historical arc of American cities,” says Molly Rose Kaufman, who discussed the project called [murmur] at the May NeighborWorks Training Institute on Purposeful and Powerful Storytelling. “De-industrialization left it with a declining population and employer base, and a lot of vacant properties. It’s a contagious process. A lot of young people just want to escape; they don’t know or connect with the rich history of the town, and the progress that’s happening that should make them proud.”

Murmur, however, has helped change that dynamic. The concept, first piloted in Toronto and now in cities ranging from Sao Paulo to Edinburgh, is simple: Record stories of residents explaining the history behind a particular spot – whether a park, a building or just an intersection – and set up “listening posts” around town. A green ear-shaped sign marks the location of each story, inviting passers-by to call a special phone number and listen to a narrative about what happened at that spot in the past.

Orange now has 15 sites, all within four to five blocks, with 30 stories. The stories run the gamut from memories of boxing legend and Orange native Tony Galento, to recollections of Martin Luther King Jr.'s visit shortly before his death, to the accomplishments of local hero Monte Irvin, who was inducted into the Baseball Hall of Fame for his performance with the Orange Triangles, a professional baseball team in the Negro National League. (Click on the links to hear for yourself.)

While HANDS loved the idea of being part of an international movement, however, it gave the concept its own twist.

“We recruited high school students in our youth arts program to find and record the stories,” explains Kaufman, who launched the program while a community organizer with HANDS. “Some of them ended up telling their own, personal stories. It was the first time for many of them to discover and appreciate that they have roots in a pretty fascinating town.”

One of the eight youth who recorded those first stories was Khemani Gibson. And he is quick to agree that the [murmur] project changed his life – by awakening a love of history, and his town.Gibson was born in Jamaica, but moved with his family to Orange when he was just a few months old.

“But I really didn’t feel any connection to Orange until [murmur],” he says. “Actually, I wanted my family to move. I just saw it as a broken-down town. Now, though, after learning so much about the city’s history and the people, my perception has changed to ‘why would I want to leave this place?’”

Gibson is particularly interested in black history, and has gone on to major in pan-African studies and Spanish at New Jersey’s Drew University. He returns to Orange regularly, however, to help the next generation of youth follow in his footsteps. Since September, he has been working with sixth through eighth graders to help them gather a new round of stories that will be used not only to update the listening stations but to develop a booklet about their city’s history for the third-grade curriculum.

“I was a little apprehensive at first, thinking that maybe the kids would be too young to really engage on this topic,” laughs Gibson. “But they ask questions like you’d hear at a town hall meeting; I’m learning a lot from them.”

And what’s next for Gibson? He already is planning to pursue his Ph.D., focusing on the African diaspora, but ultimately, “I feel so connected to Orange now that I wouldn’t mind coming back when I’m done.”

Next post: Tips for recording your own “naked voice” interviews.

This is the second post in a three-part series on the power of oral storytelling. Read the first post.

HANDS, a NeighborWorks member in Orange, NJ, was an early believer in the power and versatility of the human voice, and has put the medium to a unique use – an oral history “tour” of the community that is helping the old and young alike re-discover why they should love their home town.

“Orange is only 2.2 square miles, but sort of embodies the historical arc of American cities,” says Molly Rose Kaufman, who discussed the project called [murmur] at the May NeighborWorks Training Institute on Purposeful and Powerful Storytelling. “De-industrialization left it with a declining population and employer base, and a lot of vacant properties. It’s a contagious process. A lot of young people just want to escape; they don’t know or connect with the rich history of the town, and the progress that’s happening that should make them proud.”

Murmur, however, has helped change that dynamic. The concept, first piloted in Toronto and now in cities ranging from Sao Paulo to Edinburgh, is simple: Record stories of residents explaining the history behind a particular spot – whether a park, a building or just an intersection – and set up “listening posts” around town. A green ear-shaped sign marks the location of each story, inviting passers-by to call a special phone number and listen to a narrative about what happened at that spot in the past.

|

| Two [murmur] volunteers interview a resident about a local story. |

While HANDS loved the idea of being part of an international movement, however, it gave the concept its own twist.

“We recruited high school students in our youth arts program to find and record the stories,” explains Kaufman, who launched the program while a community organizer with HANDS. “Some of them ended up telling their own, personal stories. It was the first time for many of them to discover and appreciate that they have roots in a pretty fascinating town.”

|

| Khemani Gibson (left) in the process of installing the ear-shaped [murmur] signs. |

“But I really didn’t feel any connection to Orange until [murmur],” he says. “Actually, I wanted my family to move. I just saw it as a broken-down town. Now, though, after learning so much about the city’s history and the people, my perception has changed to ‘why would I want to leave this place?’”

Gibson is particularly interested in black history, and has gone on to major in pan-African studies and Spanish at New Jersey’s Drew University. He returns to Orange regularly, however, to help the next generation of youth follow in his footsteps. Since September, he has been working with sixth through eighth graders to help them gather a new round of stories that will be used not only to update the listening stations but to develop a booklet about their city’s history for the third-grade curriculum.

“I was a little apprehensive at first, thinking that maybe the kids would be too young to really engage on this topic,” laughs Gibson. “But they ask questions like you’d hear at a town hall meeting; I’m learning a lot from them.”

And what’s next for Gibson? He already is planning to pursue his Ph.D., focusing on the African diaspora, but ultimately, “I feel so connected to Orange now that I wouldn’t mind coming back when I’m done.”

Next post: Tips for recording your own “naked voice” interviews.

Friday, June 20, 2014

Have a story to tell? Try focusing on the ‘naked voice’

By Pam Bailey, NeighborWorks America blogger

Video is all the rage these days, with YouTube views in the millions and the rise of new social-media apps like Vine. But while there is no doubt that video is a powerful way to tell a story, it can be an expensive, time-consuming tool – and not always the best or only way to “move” hearts and minds.

At May’s NeighborWorks Training Institute symposium, Telling a Purposeful and Powerful Story, three of the speakers highlighted what they call one of the most overlooked vehicles for storytelling – oral narratives.

“The soul is ‘contained’ in the human voice,” says Dave Isay, founder of StoryCorps, former NPR producer and the symposium’s keynote speaker. “It’s like someone is whispering in your ear; it’s much more intimate. When it comes right down to it, everything else is a distraction.”

I know exactly what Isay means, in a very personal way. Several years ago, as my mother and father edged into their 80s and I knew their years were likely numbered, I ordered a “do-it-yourself home kit” from StoryCorps so that I could capture their memories, and their advice for the next generation, before it was too late. (Today, it is much easier; you only need your smart phone or laptop to record, then upload a recording to StoryCorps’ Wall of Listening. Check it out.) Last August, my father succumbed to illness, and died before I could fly out to be with him. Alone in my sadness, I played the recording of our conversation. Indeed, it was like he was “whispering in my ear.”

I really don’t believe that the stories told by my father would have touched me in such a deep, visceral way if I had watched a video, with its attendant focus on background, lighting and physical appearance. If you doubt the impact that the “naked voice” can have, listen to the StoryCorps selections aired each week on NPR's Morning Edition. (There were few dry eyes in the room when the 400-plus attendees at our Louisville NTI symposium listened to the stories played by Isay during his talk.)

For nonprofits with small budgets, there is another advantage of oral stories, says Neal Augenstein, the tech editor for DC’s WTOP radio and a symposium workshop leader. “Audio is easy to digest, and unlike video, can be appreciated even while listeners are doing something else. Video is also very difficult to do well, and bad video isn’t worth doing.”

Harnessing audio for organizations

One NeighborWorks organization is about to experiment with its own oral narrative project: Neighborhood Housing Services of Chicago is working with the StoryCorps organization through the local NPR affiliate, WBEZ. A team will set up a booth at one of the organization’s offices Aug. 5, record six to eight stories and help edit them down to two to three minutes for social-media and other types of sharing. The organization lucked out; Chicago is one of three U.S. cities where StoryCorps operates permanent recording centers (StoryBooths), along with Atlanta and San Francisco. (In the next few weeks, the studio in Chicago -- located in the Chicago Cultural Center, an 1897 historical landmark -- will be expanded to include an exhibition space, including interactive listening kiosks and a photo wall.)

Organizations located in other cities may pay a sliding fee for a crew to come to them. You can also record oral narratives on your own (the next post in this series offers tips). However, only StoryCorps-facilitated interviews not included in its Library of Congress collection or considered for airing on NPR. (A warning: Don't consider participating in an activity like this based on possible NPR coverage! StoryCorps reports that due to the sheer volume of narratives it collects, fewer than 1 percent are aired. Rather, do it to incorporate compelling storytelling into your own outreach and promotion.)

The stories collected by NHS of Chicago will focus on the importance of home, tying into the Home Matters initiative.

“We’re very good at collecting data to document our work, but we want to find more creative ways to tell the story behind the numbers,” explains Mary Carlson, director of resource development and public affairs for NHS of Chicago. “I’m a longtime fan of the NPR StoryCorps segments and wait in my car before going into the office just so that I can listen. When you focus in on just the voice, you feel like you’re in your own ‘bubble.’”

Next post: A New Jersey organization uses audio storytelling to build community by connecting residents with their history.

Video is all the rage these days, with YouTube views in the millions and the rise of new social-media apps like Vine. But while there is no doubt that video is a powerful way to tell a story, it can be an expensive, time-consuming tool – and not always the best or only way to “move” hearts and minds.

At May’s NeighborWorks Training Institute symposium, Telling a Purposeful and Powerful Story, three of the speakers highlighted what they call one of the most overlooked vehicles for storytelling – oral narratives.

“The soul is ‘contained’ in the human voice,” says Dave Isay, founder of StoryCorps, former NPR producer and the symposium’s keynote speaker. “It’s like someone is whispering in your ear; it’s much more intimate. When it comes right down to it, everything else is a distraction.”

I know exactly what Isay means, in a very personal way. Several years ago, as my mother and father edged into their 80s and I knew their years were likely numbered, I ordered a “do-it-yourself home kit” from StoryCorps so that I could capture their memories, and their advice for the next generation, before it was too late. (Today, it is much easier; you only need your smart phone or laptop to record, then upload a recording to StoryCorps’ Wall of Listening. Check it out.) Last August, my father succumbed to illness, and died before I could fly out to be with him. Alone in my sadness, I played the recording of our conversation. Indeed, it was like he was “whispering in my ear.”

I really don’t believe that the stories told by my father would have touched me in such a deep, visceral way if I had watched a video, with its attendant focus on background, lighting and physical appearance. If you doubt the impact that the “naked voice” can have, listen to the StoryCorps selections aired each week on NPR's Morning Edition. (There were few dry eyes in the room when the 400-plus attendees at our Louisville NTI symposium listened to the stories played by Isay during his talk.)

|

| Neal Augenstein conducts an interview with his iPhone. |

Harnessing audio for organizations

One NeighborWorks organization is about to experiment with its own oral narrative project: Neighborhood Housing Services of Chicago is working with the StoryCorps organization through the local NPR affiliate, WBEZ. A team will set up a booth at one of the organization’s offices Aug. 5, record six to eight stories and help edit them down to two to three minutes for social-media and other types of sharing. The organization lucked out; Chicago is one of three U.S. cities where StoryCorps operates permanent recording centers (StoryBooths), along with Atlanta and San Francisco. (In the next few weeks, the studio in Chicago -- located in the Chicago Cultural Center, an 1897 historical landmark -- will be expanded to include an exhibition space, including interactive listening kiosks and a photo wall.)

Organizations located in other cities may pay a sliding fee for a crew to come to them. You can also record oral narratives on your own (the next post in this series offers tips). However, only StoryCorps-facilitated interviews not included in its Library of Congress collection or considered for airing on NPR. (A warning: Don't consider participating in an activity like this based on possible NPR coverage! StoryCorps reports that due to the sheer volume of narratives it collects, fewer than 1 percent are aired. Rather, do it to incorporate compelling storytelling into your own outreach and promotion.)

The stories collected by NHS of Chicago will focus on the importance of home, tying into the Home Matters initiative.

“We’re very good at collecting data to document our work, but we want to find more creative ways to tell the story behind the numbers,” explains Mary Carlson, director of resource development and public affairs for NHS of Chicago. “I’m a longtime fan of the NPR StoryCorps segments and wait in my car before going into the office just so that I can listen. When you focus in on just the voice, you feel like you’re in your own ‘bubble.’”

Next post: A New Jersey organization uses audio storytelling to build community by connecting residents with their history.

Monday, May 26, 2014

Singing your story: Try this to connect with your audience

By Pam Bailey, NeighborWorks America blogger

It’s every nonprofit’s Holy Grail: to communicate the “essence” of what makes your organization stand out in a way that will get your audience to stop what they are doing and pay attention. In other words, it’s a pretty tall order.

But Urban Edge, a community development corporation serving the struggling Jamaica Plain and Roxbury neighborhoods of Boston, MA, found a way to do just that for its 40th anniversary: a music video.

.

“We produce something special every five years for our landmark anniversaries,” explains Chrystal Kornegay, president and CEO, adding that it is tough to stand out when three of the five local community development financial institutions are NeighborWorks members. “For our 35th anniversary, we created a video, and we knew we wanted a new one. We are launching a major capital campaign, including an outreach targeting individual donors. We typically try to pack in every important piece of information and rely on a lot of talking heads, but this time we wanted something that would inspire.”

It’s every nonprofit’s Holy Grail: to communicate the “essence” of what makes your organization stand out in a way that will get your audience to stop what they are doing and pay attention. In other words, it’s a pretty tall order.

But Urban Edge, a community development corporation serving the struggling Jamaica Plain and Roxbury neighborhoods of Boston, MA, found a way to do just that for its 40th anniversary: a music video.

.

If that wasn’t enough of a challenge, Kornegay also wanted a vehicle that would appeal to a younger audience as well as the organization’s traditional base.

Knowing she wanted something different, but not what, Kornegay turned to Small Army, a boutique advertising agency that had done good work for another area nonprofit. On its website, the team states upfront that it shares Kornegay’s fatigue with scripts laden with facts. “We believe that advertising doesn't work anymore and that building campaigns off of key messages is outdated…(Rather,) we believe that marketing is about sharing stories and creating relationships.”

The Small Army team spent 20 to 30 hours getting to know Urban Edge – not by reading its website and annual reports, but by listening: to staff, board members, community residents and funders.

The first challenge: defining the core value to convey

“What struck me the most is that everybody is so respectful of each other,” recalls Steve Kolander, Small Army’s president. “And respect is clearly important in the communities Urban Edge serves. Residents don’t get it from so many others, but they find it at Urban Edge. When you walk in, there’s always someone offering to roll up their sleeves and help. That’s the culture.”

But how do you convey that without sounding preachy or phony?

“I was flying home from a business trip to Los Angeles, and I had some ‘captive’ time. That’s when it came to me. One of the best ways to connect emotionally with people is through music,” says Steve, a one-time singer-songwriter. “I started with the lyrics, and the melody came later – but I was searching for sort of a gospel feel, without being overtly religious. Gospel is all about overcoming challenges and standing up for yourself and others. That’s the spirit I wanted to invoke.”

Kolander wasn’t sure, however, how Kornegay would react. And neither was she when he returned and told her his idea.

“I was a little hesitant,” admitted Kornegay. “But I trusted his instincts.”

Tapping into local talent

Urban Edge put out a “casting call,” and two men from the community responded – including Curtis Henderson, executive director of Boston Neighborhood Networks (BNN). Urban Edge partnered with BNN to develop its headquarters building. The others were found by Small Army from surrounding neighborhoods. There was no audition; “there was no time for that,” laughs Kolander. Urban Edge wanted to debut the video at its rapidly approaching annual meeting.

One of the most surprising “finds,” Kornegay and Kolander agree, was 14-year-old Rebecca Zama, who was strong enough to serve as the lead vocalist. Her mother, Nunotte, had intended to merely drop her daughter off. And when Kolander asked playfully if she sang too, she initially responded, “Oh, no, honey! I’m just the driver!” But when Rebecca insisted that her mother also sang, “Mama Zama” quickly took off her jacket and joined them. (A nice coincidence: Nunotte Zama is a graduate of the Urban Edge foreclosure counseling program.)

Three locations and a day later, the soundtrack was captured. It took another five or so days to edit. And then it was time to unveil.

“When I saw the result, I cried,” says Kornegay. “And ever since we first showed it at the annual meeting, people have been asking for it. It’s gone viral in our community.”

Would a song or a music video be a good way of telling your own organization’s story? It was not an inexpensive project for Urban Edge. Kornegay estimates the total cost to her organization at $40,000. But it’s an expense she will only repeat once every five years. If that is too steep a cost, a funder could perhaps be found to underwrite it, or volunteer talent could be tapped. The key is to experiment with how you tell your story, and to be willing to go a little out of the box!

The Small Army team spent 20 to 30 hours getting to know Urban Edge – not by reading its website and annual reports, but by listening: to staff, board members, community residents and funders.

The first challenge: defining the core value to convey

“What struck me the most is that everybody is so respectful of each other,” recalls Steve Kolander, Small Army’s president. “And respect is clearly important in the communities Urban Edge serves. Residents don’t get it from so many others, but they find it at Urban Edge. When you walk in, there’s always someone offering to roll up their sleeves and help. That’s the culture.”

But how do you convey that without sounding preachy or phony?

“I was flying home from a business trip to Los Angeles, and I had some ‘captive’ time. That’s when it came to me. One of the best ways to connect emotionally with people is through music,” says Steve, a one-time singer-songwriter. “I started with the lyrics, and the melody came later – but I was searching for sort of a gospel feel, without being overtly religious. Gospel is all about overcoming challenges and standing up for yourself and others. That’s the spirit I wanted to invoke.”

Kolander wasn’t sure, however, how Kornegay would react. And neither was she when he returned and told her his idea.

“I was a little hesitant,” admitted Kornegay. “But I trusted his instincts.”

Tapping into local talent

Urban Edge put out a “casting call,” and two men from the community responded – including Curtis Henderson, executive director of Boston Neighborhood Networks (BNN). Urban Edge partnered with BNN to develop its headquarters building. The others were found by Small Army from surrounding neighborhoods. There was no audition; “there was no time for that,” laughs Kolander. Urban Edge wanted to debut the video at its rapidly approaching annual meeting.

One of the most surprising “finds,” Kornegay and Kolander agree, was 14-year-old Rebecca Zama, who was strong enough to serve as the lead vocalist. Her mother, Nunotte, had intended to merely drop her daughter off. And when Kolander asked playfully if she sang too, she initially responded, “Oh, no, honey! I’m just the driver!” But when Rebecca insisted that her mother also sang, “Mama Zama” quickly took off her jacket and joined them. (A nice coincidence: Nunotte Zama is a graduate of the Urban Edge foreclosure counseling program.)

Three locations and a day later, the soundtrack was captured. It took another five or so days to edit. And then it was time to unveil.

“When I saw the result, I cried,” says Kornegay. “And ever since we first showed it at the annual meeting, people have been asking for it. It’s gone viral in our community.”

Would a song or a music video be a good way of telling your own organization’s story? It was not an inexpensive project for Urban Edge. Kornegay estimates the total cost to her organization at $40,000. But it’s an expense she will only repeat once every five years. If that is too steep a cost, a funder could perhaps be found to underwrite it, or volunteer talent could be tapped. The key is to experiment with how you tell your story, and to be willing to go a little out of the box!

Thursday, May 1, 2014

Eddie’s story: Foreclosure ends one chapter, starts another

By Pam Bailey, NeighborWorks America blogger

Below is the final story in our four-part series on “life after foreclosure.” Read the previous posts beginning here.

One of the lessons Eddie Hines has learned from his ordeal of the past four years is to seek professional help early.

Hines and his wife bought a house in Pittsburgh in 2000. It was their first, and he admits now that they did it “blindly” – without the expert counseling provided by organizations like NeighborWorks of Western Pennsylvania, which stepped in later to help, in much less happy circumstances.

Hines was in good company, unfortunately. A survey commissioned by NeighborWorks America last fall found that when asked where they would go first for advice before buying a house, more than a third of American adults (39 percent) cited family and friends who had already purchased a home. Distant runners-up were the Internet (17 percent) and real estate agents (16 percent). Far behind were housing counselors and (more specifically) non-profit homeownership advisers (3 and 5 percent, respectively).

“We bought directly from the owner, and he took advantage of our obliviousness,” recalls Hines. “We basically paid too much.”

Still, they lived in their home comfortably until Hines, a school counselor, lost his second job with the local newspaper when his shift was cut. The income on which the family of four had relied dropped significantly, and they didn’t make the necessary budget changes. “We had gotten attached to a certain lifestyle,” he admits now. “We didn’t face up to reality.”

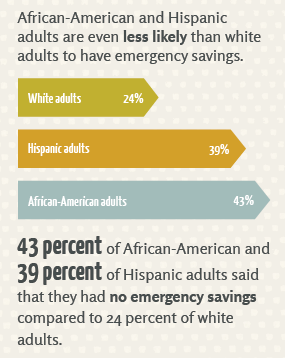

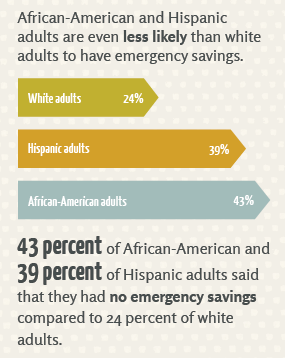

Once again, Hines was part of a national “epidemic.” A 2014 survey commissioned by NeighborWorks America found that almost a third of adults have no emergency savings, and another 21 percent have only enough to tide them over for a month. A related poll conducted by the National Foundation for Credit Counseling documented that just two in five U.S. adults (39%) – a proportion that has held roughly steady since 2007 – say they have a budget and keep close track of their spending.

The resulting stress proved too much for Hines’ marriage, and his wife moved out, leaving him solely responsible for the house. When he became ill, forcing him to take extended sick leave from his job at the school, it was the proverbial last straw. Hines tried to apply for a loan modification while he was still paying, but was denied because he was current – a common Catch 22. When Hines eventually fell behind on his mortgage payments, he was denied once again due to his wife’s refusal to co-sign.

Finally, he turned to Devon March, a counselor at NeighborWorks of Western Pennsylvania.

“I was extremely stressed at that point,” he recalls. “I had lost my family, and living alone. Devon assessed the situation and asked me a simple, direct question, ‘Is this house worth the cost to you to keep it?’ And I realized the answer was no.”

Since then, Hines and March have become more than just client and counselor, frequently emailing each other to keep in touch. Today, Hines is renting an apartment and is back at work. He is still meeting with March, this time to build a budget and action plan so that he can someday become a homeowner again. With her help, he is on track to achieve that – just not right now.

“Eddie has a very positive attitude,” March says. “It’s like he has begun a second life. Now that he has a plan, he can sleep at night.”

Hines agrees: “Overall, I can say now that the ordeal has had some positive effects. If you take this kind of thing too much to heart, it will destroy you. But I’ve discovered my own resilience, and learned not to take everything so personally. I can’t control the actions of everyone else, so I am focusing on me.”

Although he is happy in his apartment for now, Hines still values homeownership because “it teaches my children, for whom I want to be a role model, to strive for your goals. They look to see how you handle adversity, and I want to show them that you can bounce back.”

Below is the final story in our four-part series on “life after foreclosure.” Read the previous posts beginning here.

One of the lessons Eddie Hines has learned from his ordeal of the past four years is to seek professional help early.

Hines and his wife bought a house in Pittsburgh in 2000. It was their first, and he admits now that they did it “blindly” – without the expert counseling provided by organizations like NeighborWorks of Western Pennsylvania, which stepped in later to help, in much less happy circumstances.

Hines was in good company, unfortunately. A survey commissioned by NeighborWorks America last fall found that when asked where they would go first for advice before buying a house, more than a third of American adults (39 percent) cited family and friends who had already purchased a home. Distant runners-up were the Internet (17 percent) and real estate agents (16 percent). Far behind were housing counselors and (more specifically) non-profit homeownership advisers (3 and 5 percent, respectively).

“We bought directly from the owner, and he took advantage of our obliviousness,” recalls Hines. “We basically paid too much.”

Still, they lived in their home comfortably until Hines, a school counselor, lost his second job with the local newspaper when his shift was cut. The income on which the family of four had relied dropped significantly, and they didn’t make the necessary budget changes. “We had gotten attached to a certain lifestyle,” he admits now. “We didn’t face up to reality.”

|

| A NeighborWorks America survey found a widespread lack of emergency savings. |

The resulting stress proved too much for Hines’ marriage, and his wife moved out, leaving him solely responsible for the house. When he became ill, forcing him to take extended sick leave from his job at the school, it was the proverbial last straw. Hines tried to apply for a loan modification while he was still paying, but was denied because he was current – a common Catch 22. When Hines eventually fell behind on his mortgage payments, he was denied once again due to his wife’s refusal to co-sign.

|

| Eddie Hines and Devon March |

“I was extremely stressed at that point,” he recalls. “I had lost my family, and living alone. Devon assessed the situation and asked me a simple, direct question, ‘Is this house worth the cost to you to keep it?’ And I realized the answer was no.”

Since then, Hines and March have become more than just client and counselor, frequently emailing each other to keep in touch. Today, Hines is renting an apartment and is back at work. He is still meeting with March, this time to build a budget and action plan so that he can someday become a homeowner again. With her help, he is on track to achieve that – just not right now.

“Eddie has a very positive attitude,” March says. “It’s like he has begun a second life. Now that he has a plan, he can sleep at night.”

Hines agrees: “Overall, I can say now that the ordeal has had some positive effects. If you take this kind of thing too much to heart, it will destroy you. But I’ve discovered my own resilience, and learned not to take everything so personally. I can’t control the actions of everyone else, so I am focusing on me.”

Although he is happy in his apartment for now, Hines still values homeownership because “it teaches my children, for whom I want to be a role model, to strive for your goals. They look to see how you handle adversity, and I want to show them that you can bounce back.”

Wednesday, April 30, 2014

Preserving ‘home’ after break-up and illness: Angela’s and Winnie’s stories

By Pam Bailey, NeighborWorks America blogger

Below are the stories of two women who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – with two different outcomes, but the same fighting spirit. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the previous posts here and here.

Angela Hawthorne, Illinois

“Happily ever after” is one of those fairy-tale phrases that in real life, only applies to about 50 percent of marriages. That’s what Angela Hawthorne discovered, nine years after she and her husband moved into a house in Flossmoor, IL, with their two children.

Suddenly, Hawthorne found herself responsible for a mortgage on her own, on an income that had dropped precipitously when she took a leave of absence from her job as an underwriter for professional liability insurance to care for her ailing father. She attempted to negotiate with the lender directly and received a significant modification that gave her some breathing room -- but for three months only.

“I would find myself crying in the shower in the morning,” recalls Hawthorne. “But I couldn’t show it. At home, I had two kids to look out for, a daughter going on 15 and a 6-year-old son. I had to keep up a good front so their life was as normal as possible, and they could concentrate at school. I didn’t want them to worry about what was going on.”

In April 2012, a county mediation service referred Hawthorne to the South Side Community Federal Credit Union, where counselor Wilane Boone reviewed and improved her application for a loan modification. Unfortunately, Hawthorne failed to meet Federal Housing Administration guidelines for her debt-to-income ratio, and a summary judgment was issued authorizing foreclosure. Nevertheless, Hawthorne credits Boone for helping her navigate through the confusing and jarring process.

“Wilane was very insightful, and was always very straightforward and honest with me,” says Hawthorne. “She explained everything to me step by step and kept track of all of the paperwork so it wouldn’t get lost in the system. I never felt in the dark – which was huge for me.”

There is a happy ending to this story, however. Despite declaring personal bankruptcy in July 2013, she is now renting a new home, with hopes of purchasing it one day, just 15 minutes from the house she lost. Her children didn’t even have to change school districts.

“I learned that sometimes you have to just let go, and rely on your inner strength,” says Hawthorne, adding that for her, that strength came from a re-discovered faith in God. “Once I did, I felt a calm come over me.”

Winifred Octave, Massachusetts

Unemployment, or a significant reduction in pay, is the trigger for more than 60 percent of families who seek help from advisers who receive support from Neighborworks’ National Foreclosure Mitigation Counseling program. “Winnie” Octave, a single mother of three, brings that statistic to life.

Octave bought her rehabbed home in Worcester, MA, in 2001 from a local community development corporation. All was fine until she suffered a serious break in her arm and could not work at her job as an administrative assistant with the city’s bankruptcy court. Octave was replaced, and now unemployed, she struggled to pay her mortgage.

“I called my bank before I stopped paying, but they told me I had to fall behind before they would talk to me! It’s like a trap,” remembers Octave. “So I paid my overdue credit card bills instead. When I couldn’t pay the mortgage any longer, the bank gave me six months forbearance. But when the time was up, I still hadn’t been able to get a job.”

In 2010, when she had fallen behind on her mortgage for nearly two years, Octave attended a community-education forum at a local high school and heard someone speak from the Oak Hill Community Development Corporation.

“It was the best thing that ever happened to me,” says Octave. “I’d been submitting and submitting paperwork, and getting nowhere. Thinking about it now is like torture!”

Janice St. Amand, a foreclosure counselor at the Oak Hill CDC, says that even today, many clients tell her they are advised, wrongly, to deliberately fall behind on their mortgages, and then are unable to catch up when they are turned down for a modification.

“What’s key is to determine your priorities,” says St. Amand, who describes Octave as her first “complicated” client. “For Winnie, it was very clear: She wanted to save her house, and that meant putting aside money for her mortgage before anything else so she could show her intent. Winnie is a wonderful listener. I told her that we had to work as a team; that we don’t work for our clients, but with them. She understood what was needed and followed through.”

Meanwhile, Octave had landed a part-time job, allowing her to save more money, supplemented by a letter from a tenant she had taken on as a renter as well as another from her oldest son, who moved in to help her financially after returning from a military deployment in Iraq. She also leveraged her community connections as a very engaged resident, appealing to her state representative. In October of 2011, Octave was granted her loan modification, and her home was saved.

It hasn’t been easy since then. Octave was forced to file for personal bankruptcy to get out from under her crushing credit card debt, and today, she is once again unemployed. However, this time she is optimistic, confident she is in her home to stay. Her family has come together in support and she is “working” her wealth of community connections – an asset that is a benefit of being an involved citizen.

“This experience has brought my whole family so much closer together,” she says. “My middle daughter, for instance, used to act only for herself. But now, she is my best friend and she takes me out for treats like a manicure. Even my youngest son in college sends me money once in a while.”

In turn, Octave wants to help other people in her situation, perhaps by going after absentee owners who neglect their property or cleaning up neighborhoods – but also by sharing what she has learned.

“One of my biggest lessons was to budget!” says Octave, who participated in the Oak Hill CDC’s financial-education classes. “I always paid my bills, but I didn’t put any away for emergencies. I didn’t think about what could go wrong. Today, I find a way to save some money every month, instead of going out to dinner, for instance, and I’ve got $10,000 put away now.”

Octave is not alone. A new, national survey commissioned by NeighborWorks America found that almost a third of adults have no emergency savings, and another 21 percent have only enough to tide them over for a month. The problem is particularly pronounced among African-Americans, Hispanics and households earning less than $40,000 a year.

Why is homeownership still important to Octave, despite the stresses?

“My house is important because it’s mine; it’s what I can leave my kids,” she explains. “If I rent, it’s like I am giving other people a part of me. I am not giving up my home for anything.”

Next post: Eddie’s story – ending one chapter to start another. To receive it in your inbox, subscribe in the box in the right margin.

Below are the stories of two women who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – with two different outcomes, but the same fighting spirit. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the previous posts here and here.

Angela Hawthorne, Illinois

“Happily ever after” is one of those fairy-tale phrases that in real life, only applies to about 50 percent of marriages. That’s what Angela Hawthorne discovered, nine years after she and her husband moved into a house in Flossmoor, IL, with their two children.

|

| Angela Hawthorne |

“I would find myself crying in the shower in the morning,” recalls Hawthorne. “But I couldn’t show it. At home, I had two kids to look out for, a daughter going on 15 and a 6-year-old son. I had to keep up a good front so their life was as normal as possible, and they could concentrate at school. I didn’t want them to worry about what was going on.”

In April 2012, a county mediation service referred Hawthorne to the South Side Community Federal Credit Union, where counselor Wilane Boone reviewed and improved her application for a loan modification. Unfortunately, Hawthorne failed to meet Federal Housing Administration guidelines for her debt-to-income ratio, and a summary judgment was issued authorizing foreclosure. Nevertheless, Hawthorne credits Boone for helping her navigate through the confusing and jarring process.

“Wilane was very insightful, and was always very straightforward and honest with me,” says Hawthorne. “She explained everything to me step by step and kept track of all of the paperwork so it wouldn’t get lost in the system. I never felt in the dark – which was huge for me.”

There is a happy ending to this story, however. Despite declaring personal bankruptcy in July 2013, she is now renting a new home, with hopes of purchasing it one day, just 15 minutes from the house she lost. Her children didn’t even have to change school districts.

“I learned that sometimes you have to just let go, and rely on your inner strength,” says Hawthorne, adding that for her, that strength came from a re-discovered faith in God. “Once I did, I felt a calm come over me.”

Winifred Octave, Massachusetts

Unemployment, or a significant reduction in pay, is the trigger for more than 60 percent of families who seek help from advisers who receive support from Neighborworks’ National Foreclosure Mitigation Counseling program. “Winnie” Octave, a single mother of three, brings that statistic to life.

Octave bought her rehabbed home in Worcester, MA, in 2001 from a local community development corporation. All was fine until she suffered a serious break in her arm and could not work at her job as an administrative assistant with the city’s bankruptcy court. Octave was replaced, and now unemployed, she struggled to pay her mortgage.

“I called my bank before I stopped paying, but they told me I had to fall behind before they would talk to me! It’s like a trap,” remembers Octave. “So I paid my overdue credit card bills instead. When I couldn’t pay the mortgage any longer, the bank gave me six months forbearance. But when the time was up, I still hadn’t been able to get a job.”

|

| Winnie Octave (second from right) and (from left) her daughter Danielle; son Rohan; nephew Juddah; and son Tarik. |

“It was the best thing that ever happened to me,” says Octave. “I’d been submitting and submitting paperwork, and getting nowhere. Thinking about it now is like torture!”

Janice St. Amand, a foreclosure counselor at the Oak Hill CDC, says that even today, many clients tell her they are advised, wrongly, to deliberately fall behind on their mortgages, and then are unable to catch up when they are turned down for a modification.

“What’s key is to determine your priorities,” says St. Amand, who describes Octave as her first “complicated” client. “For Winnie, it was very clear: She wanted to save her house, and that meant putting aside money for her mortgage before anything else so she could show her intent. Winnie is a wonderful listener. I told her that we had to work as a team; that we don’t work for our clients, but with them. She understood what was needed and followed through.”

Meanwhile, Octave had landed a part-time job, allowing her to save more money, supplemented by a letter from a tenant she had taken on as a renter as well as another from her oldest son, who moved in to help her financially after returning from a military deployment in Iraq. She also leveraged her community connections as a very engaged resident, appealing to her state representative. In October of 2011, Octave was granted her loan modification, and her home was saved.

|

| A survey from NeighborWorks America shows many Americans are like Octave and do not have emergency savings. |

“This experience has brought my whole family so much closer together,” she says. “My middle daughter, for instance, used to act only for herself. But now, she is my best friend and she takes me out for treats like a manicure. Even my youngest son in college sends me money once in a while.”

In turn, Octave wants to help other people in her situation, perhaps by going after absentee owners who neglect their property or cleaning up neighborhoods – but also by sharing what she has learned.

“One of my biggest lessons was to budget!” says Octave, who participated in the Oak Hill CDC’s financial-education classes. “I always paid my bills, but I didn’t put any away for emergencies. I didn’t think about what could go wrong. Today, I find a way to save some money every month, instead of going out to dinner, for instance, and I’ve got $10,000 put away now.”

Octave is not alone. A new, national survey commissioned by NeighborWorks America found that almost a third of adults have no emergency savings, and another 21 percent have only enough to tide them over for a month. The problem is particularly pronounced among African-Americans, Hispanics and households earning less than $40,000 a year.

Why is homeownership still important to Octave, despite the stresses?

“My house is important because it’s mine; it’s what I can leave my kids,” she explains. “If I rent, it’s like I am giving other people a part of me. I am not giving up my home for anything.”

Next post: Eddie’s story – ending one chapter to start another. To receive it in your inbox, subscribe in the box in the right margin.

Tuesday, April 29, 2014

‘Fixer-upper’ to foreclosure: Walter and Dorothy’s story

By Pam Bailey, NeighborWorks America blogger

Below is the story of a couple who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – ultimately losing their house, but already laying the groundwork to become homeowners once again, with a bit more wisdom. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the first post here.

When she and her husband first set eyes on their soon-to-be home on Oct. 25, 1995, “the house looked like a nightmare from hell,” says Dorothy James. With the house in Roxbury, MA, damaged by fire, the original owner no longer wanted to invest money or time in the structure. However, with her flair for interior decorating, she saw a labor of love, and Dorothy and Walter James made it their own.

With a couple of re-financings and a healthy income from her job as a property manager and Walter’s in telecommunications, they were able to remodel the home in three phases. The couple ran into trouble, however, when James lost her job. The initially low interest rate on their last “creative” financing deal ballooned, and now that she was out of work, no one would offer a fixed rate.

“Our mortgage payment jumped from $1,488 a month to more than $4,000,” James recalls. “There’s no way we could have afforded that. I looked for a job desperately, while I dipped into my 401k. We got a small modification that dropped the payment by about $1,000, but we were flat broke at that point and it wasn’t enough.”