District Director, Rocky Mountain Region

How do neighborhoods go from declining to improving? Fifth Ward Community Redevelopment Corporation (Fifth Ward CRC) has used partnerships to help turn around Houston’s Fifth Ward. Most recently, Fifth Ward CRC partnered with Starbucks, during their Global Leadership Conference in Houston, to make a positive difference in the lives of the Fifth Ward residents.

|

| Starbucks "Team Blue" built a playground |

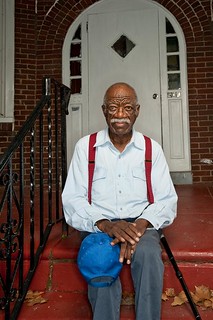

In early October, more than 5,000 Starbucks employees volunteered with community members to make a tangible impact. Starbucks CEO Howard Schultz said to KHOU 11 News “When I walked through the Fifth Ward and saw the conditions of the houses and really the people in need, I just thought this is where we need to be.”

In the Fifth Ward, the day began when the thousands of Starbucks volunteers took a bus from their downtown hotels to staging grounds at local churches. There, they ate lunch, learned about the Fifth Ward neighborhood and grabbed the tools they needed to paint homes, install pocket parks and community gardens, clean up vacant lots, put up community artwork and the like. Fifth Ward CRC projects focused on the Lyon’s Avenue Corridor, a 22 block area which encompasses the community’s “main street” and comprised of residential, commercial and public spaces with a unique blend of historical markers reflective of the community’s native sons and daughters.

In total, more than 9,000 Starbucks employees who attended the Global Leadership Conference participated in volunteer projects across Houston. On average, the Starbucks employees volunteered between four and six hours at each project for an impressive total of more than 42,000 hours of community service over the three days of the conference.

|

| Lyons Avenue Renaissance sign with numerous partners listed |

For the Lyon’s Avenue Corridor area, the volunteering was just one piece of the ongoing revitalization work. Fifth Ward CRC is committed to a complete community renaissance, which will include not only great homes and clean streets, but also new jobs and opportunities. Michael Emerson, Chairman of the Fifth Ward CDC told KHOU 11, “This is an image for us of what Fifth Ward is going to be,” said “We’re creating an economically diverse, ethnically diverse, economically strong, new neighborhood here in Houston.” Fifth Ward CRC has formed partnerships not only with Starbucks, but also with the City of Houston, Rice University, University of Houston and the American Regional Institute of Architects to change the landscape and future of Fifth Ward. With the help of collaborations like these, Fifth Ward CRC can return to being a “neighborhood of choice.”

To learn more about the Starbucks-Fifth Ward partnership, view this news video or click here to see more photos.