By Pam Bailey, NeighborWorks America blogger

Below are the stories of two women who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – with two different outcomes, but the same fighting spirit. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the previous posts here and here.

Angela Hawthorne, Illinois

“Happily ever after” is one of those fairy-tale phrases that in real life, only applies to about 50 percent of marriages. That’s what Angela Hawthorne discovered, nine years after she and her husband moved into a house in Flossmoor, IL, with their two children.

Suddenly, Hawthorne found herself responsible for a mortgage on her own, on an income that had dropped precipitously when she took a leave of absence from her job as an underwriter for professional liability insurance to care for her ailing father. She attempted to negotiate with the lender directly and received a significant modification that gave her some breathing room -- but for three months only.

“I would find myself crying in the shower in the morning,” recalls Hawthorne. “But I couldn’t show it. At home, I had two kids to look out for, a daughter going on 15 and a 6-year-old son. I had to keep up a good front so their life was as normal as possible, and they could concentrate at school. I didn’t want them to worry about what was going on.”

In April 2012, a county mediation service referred Hawthorne to the South Side Community Federal Credit Union, where counselor Wilane Boone reviewed and improved her application for a loan modification. Unfortunately, Hawthorne failed to meet Federal Housing Administration guidelines for her debt-to-income ratio, and a summary judgment was issued authorizing foreclosure. Nevertheless, Hawthorne credits Boone for helping her navigate through the confusing and jarring process.

“Wilane was very insightful, and was always very straightforward and honest with me,” says Hawthorne. “She explained everything to me step by step and kept track of all of the paperwork so it wouldn’t get lost in the system. I never felt in the dark – which was huge for me.”

There is a happy ending to this story, however. Despite declaring personal bankruptcy in July 2013, she is now renting a new home, with hopes of purchasing it one day, just 15 minutes from the house she lost. Her children didn’t even have to change school districts.

“I learned that sometimes you have to just let go, and rely on your inner strength,” says Hawthorne, adding that for her, that strength came from a re-discovered faith in God. “Once I did, I felt a calm come over me.”

Winifred Octave, Massachusetts

Unemployment, or a significant reduction in pay, is the trigger for more than 60 percent of families who seek help from advisers who receive support from Neighborworks’ National Foreclosure Mitigation Counseling program. “Winnie” Octave, a single mother of three, brings that statistic to life.

Octave bought her rehabbed home in Worcester, MA, in 2001 from a local community development corporation. All was fine until she suffered a serious break in her arm and could not work at her job as an administrative assistant with the city’s bankruptcy court. Octave was replaced, and now unemployed, she struggled to pay her mortgage.

“I called my bank before I stopped paying, but they told me I had to fall behind before they would talk to me! It’s like a trap,” remembers Octave. “So I paid my overdue credit card bills instead. When I couldn’t pay the mortgage any longer, the bank gave me six months forbearance. But when the time was up, I still hadn’t been able to get a job.”

In 2010, when she had fallen behind on her mortgage for nearly two years, Octave attended a community-education forum at a local high school and heard someone speak from the Oak Hill Community Development Corporation.

“It was the best thing that ever happened to me,” says Octave. “I’d been submitting and submitting paperwork, and getting nowhere. Thinking about it now is like torture!”

Janice St. Amand, a foreclosure counselor at the Oak Hill CDC, says that even today, many clients tell her they are advised, wrongly, to deliberately fall behind on their mortgages, and then are unable to catch up when they are turned down for a modification.

“What’s key is to determine your priorities,” says St. Amand, who describes Octave as her first “complicated” client. “For Winnie, it was very clear: She wanted to save her house, and that meant putting aside money for her mortgage before anything else so she could show her intent. Winnie is a wonderful listener. I told her that we had to work as a team; that we don’t work for our clients, but with them. She understood what was needed and followed through.”

Meanwhile, Octave had landed a part-time job, allowing her to save more money, supplemented by a letter from a tenant she had taken on as a renter as well as another from her oldest son, who moved in to help her financially after returning from a military deployment in Iraq. She also leveraged her community connections as a very engaged resident, appealing to her state representative. In October of 2011, Octave was granted her loan modification, and her home was saved.

It hasn’t been easy since then. Octave was forced to file for personal bankruptcy to get out from under her crushing credit card debt, and today, she is once again unemployed. However, this time she is optimistic, confident she is in her home to stay. Her family has come together in support and she is “working” her wealth of community connections – an asset that is a benefit of being an involved citizen.

“This experience has brought my whole family so much closer together,” she says. “My middle daughter, for instance, used to act only for herself. But now, she is my best friend and she takes me out for treats like a manicure. Even my youngest son in college sends me money once in a while.”

In turn, Octave wants to help other people in her situation, perhaps by going after absentee owners who neglect their property or cleaning up neighborhoods – but also by sharing what she has learned.

“One of my biggest lessons was to budget!” says Octave, who participated in the Oak Hill CDC’s financial-education classes. “I always paid my bills, but I didn’t put any away for emergencies. I didn’t think about what could go wrong. Today, I find a way to save some money every month, instead of going out to dinner, for instance, and I’ve got $10,000 put away now.”

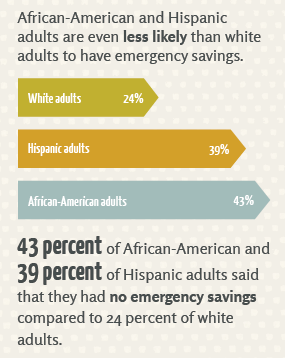

Octave is not alone. A new, national survey commissioned by NeighborWorks America found that almost a third of adults have no emergency savings, and another 21 percent have only enough to tide them over for a month. The problem is particularly pronounced among African-Americans, Hispanics and households earning less than $40,000 a year.

Why is homeownership still important to Octave, despite the stresses?

“My house is important because it’s mine; it’s what I can leave my kids,” she explains. “If I rent, it’s like I am giving other people a part of me. I am not giving up my home for anything.”

Next post: Eddie’s story – ending one chapter to start another. To receive it in your inbox, subscribe in the box in the right margin.

Below are the stories of two women who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – with two different outcomes, but the same fighting spirit. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the previous posts here and here.

Angela Hawthorne, Illinois

“Happily ever after” is one of those fairy-tale phrases that in real life, only applies to about 50 percent of marriages. That’s what Angela Hawthorne discovered, nine years after she and her husband moved into a house in Flossmoor, IL, with their two children.

|

| Angela Hawthorne |

“I would find myself crying in the shower in the morning,” recalls Hawthorne. “But I couldn’t show it. At home, I had two kids to look out for, a daughter going on 15 and a 6-year-old son. I had to keep up a good front so their life was as normal as possible, and they could concentrate at school. I didn’t want them to worry about what was going on.”

In April 2012, a county mediation service referred Hawthorne to the South Side Community Federal Credit Union, where counselor Wilane Boone reviewed and improved her application for a loan modification. Unfortunately, Hawthorne failed to meet Federal Housing Administration guidelines for her debt-to-income ratio, and a summary judgment was issued authorizing foreclosure. Nevertheless, Hawthorne credits Boone for helping her navigate through the confusing and jarring process.

“Wilane was very insightful, and was always very straightforward and honest with me,” says Hawthorne. “She explained everything to me step by step and kept track of all of the paperwork so it wouldn’t get lost in the system. I never felt in the dark – which was huge for me.”

There is a happy ending to this story, however. Despite declaring personal bankruptcy in July 2013, she is now renting a new home, with hopes of purchasing it one day, just 15 minutes from the house she lost. Her children didn’t even have to change school districts.

“I learned that sometimes you have to just let go, and rely on your inner strength,” says Hawthorne, adding that for her, that strength came from a re-discovered faith in God. “Once I did, I felt a calm come over me.”

Winifred Octave, Massachusetts

Unemployment, or a significant reduction in pay, is the trigger for more than 60 percent of families who seek help from advisers who receive support from Neighborworks’ National Foreclosure Mitigation Counseling program. “Winnie” Octave, a single mother of three, brings that statistic to life.

Octave bought her rehabbed home in Worcester, MA, in 2001 from a local community development corporation. All was fine until she suffered a serious break in her arm and could not work at her job as an administrative assistant with the city’s bankruptcy court. Octave was replaced, and now unemployed, she struggled to pay her mortgage.

“I called my bank before I stopped paying, but they told me I had to fall behind before they would talk to me! It’s like a trap,” remembers Octave. “So I paid my overdue credit card bills instead. When I couldn’t pay the mortgage any longer, the bank gave me six months forbearance. But when the time was up, I still hadn’t been able to get a job.”

|

| Winnie Octave (second from right) and (from left) her daughter Danielle; son Rohan; nephew Juddah; and son Tarik. |

“It was the best thing that ever happened to me,” says Octave. “I’d been submitting and submitting paperwork, and getting nowhere. Thinking about it now is like torture!”

Janice St. Amand, a foreclosure counselor at the Oak Hill CDC, says that even today, many clients tell her they are advised, wrongly, to deliberately fall behind on their mortgages, and then are unable to catch up when they are turned down for a modification.

“What’s key is to determine your priorities,” says St. Amand, who describes Octave as her first “complicated” client. “For Winnie, it was very clear: She wanted to save her house, and that meant putting aside money for her mortgage before anything else so she could show her intent. Winnie is a wonderful listener. I told her that we had to work as a team; that we don’t work for our clients, but with them. She understood what was needed and followed through.”

Meanwhile, Octave had landed a part-time job, allowing her to save more money, supplemented by a letter from a tenant she had taken on as a renter as well as another from her oldest son, who moved in to help her financially after returning from a military deployment in Iraq. She also leveraged her community connections as a very engaged resident, appealing to her state representative. In October of 2011, Octave was granted her loan modification, and her home was saved.

|

| A survey from NeighborWorks America shows many Americans are like Octave and do not have emergency savings. |

“This experience has brought my whole family so much closer together,” she says. “My middle daughter, for instance, used to act only for herself. But now, she is my best friend and she takes me out for treats like a manicure. Even my youngest son in college sends me money once in a while.”

In turn, Octave wants to help other people in her situation, perhaps by going after absentee owners who neglect their property or cleaning up neighborhoods – but also by sharing what she has learned.

“One of my biggest lessons was to budget!” says Octave, who participated in the Oak Hill CDC’s financial-education classes. “I always paid my bills, but I didn’t put any away for emergencies. I didn’t think about what could go wrong. Today, I find a way to save some money every month, instead of going out to dinner, for instance, and I’ve got $10,000 put away now.”

Octave is not alone. A new, national survey commissioned by NeighborWorks America found that almost a third of adults have no emergency savings, and another 21 percent have only enough to tide them over for a month. The problem is particularly pronounced among African-Americans, Hispanics and households earning less than $40,000 a year.

Why is homeownership still important to Octave, despite the stresses?

“My house is important because it’s mine; it’s what I can leave my kids,” she explains. “If I rent, it’s like I am giving other people a part of me. I am not giving up my home for anything.”

Next post: Eddie’s story – ending one chapter to start another. To receive it in your inbox, subscribe in the box in the right margin.