By Pam Bailey, NeighborWorks America blogger

Below is the story of a couple who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – ultimately losing their house, but already laying the groundwork to become homeowners once again, with a bit more wisdom. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the first post here.

When she and her husband first set eyes on their soon-to-be home on Oct. 25, 1995, “the house looked like a nightmare from hell,” says Dorothy James. With the house in Roxbury, MA, damaged by fire, the original owner no longer wanted to invest money or time in the structure. However, with her flair for interior decorating, she saw a labor of love, and Dorothy and Walter James made it their own.

With a couple of re-financings and a healthy income from her job as a property manager and Walter’s in telecommunications, they were able to remodel the home in three phases. The couple ran into trouble, however, when James lost her job. The initially low interest rate on their last “creative” financing deal ballooned, and now that she was out of work, no one would offer a fixed rate.

“Our mortgage payment jumped from $1,488 a month to more than $4,000,” James recalls. “There’s no way we could have afforded that. I looked for a job desperately, while I dipped into my 401k. We got a small modification that dropped the payment by about $1,000, but we were flat broke at that point and it wasn’t enough.”

In September of 2009, Walter James lost his job as well. It didn’t take long -- Dec. 2 to be exact -- for the bank to inform them that it was foreclosing on their home. By the following July, just two days after their 37th wedding anniversary, they were forced to leave. With no other recourse, James and her husband rented a room in the house of her sister-in-law, hitting rock bottom when she was diagnosed with breast cancer the same month.

“It was one of the most terrible experiences of our lifetimes, almost as bad as when one of our daughters died,” recalls James. “We went from a 10-room house into which we had poured our hearts and souls, to one room and having to tell our own son, who had been away at college, that he couldn’t come home. Everything we had saved was gone in a year.”

Over the course of the next year, James finally got a new job as a case manager in a drug-rehabilitation program, and they could begin to think about renting their own place. However, the cost of paying lingering, past-due utility bills, moving costs for their furniture (then in storage), deposit on an apartment, etc. was still prohibitive. That’s when James’ mother, who was seeking her own mortgage modification at the time, told them about the nonprofit that was helping her -- Urban Edge.

“We were administering a fund to assist people who lost their homes and needed assistance getting back on their feet,” explained Bob Credle, director of community programs for the community development corporation who began working with the couple in June of 2011. “We paid to release their furniture from storage, moved it to their new apartment, put down the first month’s rent and took care of their past-due gas bill.”

The total grant from Urban Edge was about $7,000 – just enough to get the couple over the hump that had prevented them from moving out on their own again. “We couldn’t have done it without Bob and Urban Edge,” James says.

Today, James has completed her cancer treatment and is back in her original profession, working as an assistant property manager and rebuilding their savings. Her husband has returned to work as well, although with an inconsistent schedule. They continue to rent a three-bedroom apartment, which they share with their son, who has since graduated from college. He will move out, but James is relieved that it will be on his own timing, when he is ready.

“The experience of going through all this has changed me to be more compassionate to others,” says James. “When you hear about people who hit hard times, it’s easy to assume they were on drugs or doing something else irresponsible. But maybe they had health problems or some other challenge. Don’t be so quick to judge; find out how they got there. That could be you one day.”

Do they want to return to being homeowners? Yes, when the time is right.

“We will definitely own our own home again someday. In an apartment, we don’t have a yard for our grandchildren to play in, to have cookouts,” James says. “I’ve learned from this whole experience, and it won’t stop us. I’m not going to let anything be taken from us again.”

Next post: Preserving ‘home’ after break-up and illness: Angela’s and Winnie’s story. To receive it in your inbox, subscribe in the box in the right margin.

Below is the story of a couple who sought help from a professional participating in NeighborWorks’ National Foreclosure Mitigation Counseling (NFMC) program – ultimately losing their house, but already laying the groundwork to become homeowners once again, with a bit more wisdom. The five stories told in this series offer a flavor of both the trauma that foreclosure inflicts on families, and the ability of the human spirit – aided by the practical support of a trusted advisor – to bounce back. Read the first post here.

When she and her husband first set eyes on their soon-to-be home on Oct. 25, 1995, “the house looked like a nightmare from hell,” says Dorothy James. With the house in Roxbury, MA, damaged by fire, the original owner no longer wanted to invest money or time in the structure. However, with her flair for interior decorating, she saw a labor of love, and Dorothy and Walter James made it their own.

With a couple of re-financings and a healthy income from her job as a property manager and Walter’s in telecommunications, they were able to remodel the home in three phases. The couple ran into trouble, however, when James lost her job. The initially low interest rate on their last “creative” financing deal ballooned, and now that she was out of work, no one would offer a fixed rate.

|

| Dorothy and Walter James with their son, Nathaniel (far left) |

In September of 2009, Walter James lost his job as well. It didn’t take long -- Dec. 2 to be exact -- for the bank to inform them that it was foreclosing on their home. By the following July, just two days after their 37th wedding anniversary, they were forced to leave. With no other recourse, James and her husband rented a room in the house of her sister-in-law, hitting rock bottom when she was diagnosed with breast cancer the same month.

Over the course of the next year, James finally got a new job as a case manager in a drug-rehabilitation program, and they could begin to think about renting their own place. However, the cost of paying lingering, past-due utility bills, moving costs for their furniture (then in storage), deposit on an apartment, etc. was still prohibitive. That’s when James’ mother, who was seeking her own mortgage modification at the time, told them about the nonprofit that was helping her -- Urban Edge.

“We were administering a fund to assist people who lost their homes and needed assistance getting back on their feet,” explained Bob Credle, director of community programs for the community development corporation who began working with the couple in June of 2011. “We paid to release their furniture from storage, moved it to their new apartment, put down the first month’s rent and took care of their past-due gas bill.”

|

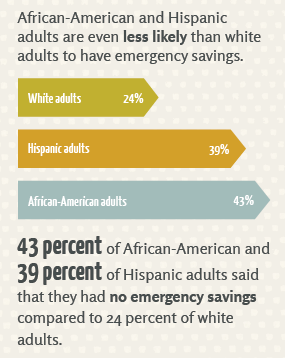

| A survey commissioned by NeighborWorks America found an widespread lack of savings. |

Today, James has completed her cancer treatment and is back in her original profession, working as an assistant property manager and rebuilding their savings. Her husband has returned to work as well, although with an inconsistent schedule. They continue to rent a three-bedroom apartment, which they share with their son, who has since graduated from college. He will move out, but James is relieved that it will be on his own timing, when he is ready.

“The experience of going through all this has changed me to be more compassionate to others,” says James. “When you hear about people who hit hard times, it’s easy to assume they were on drugs or doing something else irresponsible. But maybe they had health problems or some other challenge. Don’t be so quick to judge; find out how they got there. That could be you one day.”

Do they want to return to being homeowners? Yes, when the time is right.

“We will definitely own our own home again someday. In an apartment, we don’t have a yard for our grandchildren to play in, to have cookouts,” James says. “I’ve learned from this whole experience, and it won’t stop us. I’m not going to let anything be taken from us again.”

Next post: Preserving ‘home’ after break-up and illness: Angela’s and Winnie’s story. To receive it in your inbox, subscribe in the box in the right margin.