As with other communities across the country, the Rust Belt town of Springfield, OH, is aging. With high unemployment and the resulting exodus of young people, the population of the small town in southwestern Ohio is increasingly in need of affordable housing tailored to the needs of older individuals who want to stay in their communities, but need a little help to do so.

“Springfield is very segregated in terms of income,” explains Tina Koumoutsos, executive director of Neighborhood Housing Partnership (NHP) of Greater Springfield, which celebrated its 20th anniversary in 2013. “Most of the new development is on the north side, where the more affluent residents live. People in the southern neighborhoods don’t have as many options.”

NHP-GS is doing its part to change that, however. In 2011, it partnered with the City of Springfield to leverage funds from the second round of HUD’s Neighborhood Stabilization Program, created to assist communities whose viability is at risk in the wake of the wave of foreclosures. This funding, says Koumoutsos, was a “blessing. We had no debt to service, and could use the project instead to generate a revenue stream to invest back in our work.”

One year later, NHP offered 12 two-bedroom duplexes for rent, specifically for individuals age 55 or older who are making 50 percent of the area median income or less. In addition to reasonable rents, affordability is assured through green building practices that keep energy costs low.

“We designed these units with ‘smart growth’ in mind,” says Koumoutsos, who was the city’s housing coordinator before she became the founding director of NHP. “That means people and their special needs were our focus, not cars.”

For example, the new development was positioned to be “walkable,” with a YMCA, government offices and a performing arts center within easy reach. The property manager of the complex owns another, larger senior-service project and provides case-manager services to both developments, including recreational activities and transportation when needed.

In the units themselves, garages are positioned to the back of the homes, shifting the focus to front-yard porches where residents are encouraged to socialize with each other. The University of Michigan’s Health and Retirement Study, which is following more than 7,000 individuals, concluded that living in a neighborhood where you have strong social ties has as much physical benefit as not smoking.

In addition, the development was built with a goal of “zero steps.” Koumoutsos explains that NHP wanted the residents to be able to safely age in place, as well as to welcome disabled friends and relatives. That means no stairs that could become wheelchair obstacles, as well as special touches such as walk-in showers in the bathrooms and accessible kitchen cabinets. At the same time, however, the NHP team worked hard to make the look inviting, rather than institutional, and the second bedroom in each unit offers plenty of space for visiting children and grandchildren.

“All of the units filled almost immediately, and we have a waiting list of about 100,” says Koumoutsos. “We are in discussions now with the city about building more, since we own the adjacent land.”

“Impact” is what Koumoutsos and her team strive for. A recent study documented that in the last five years, NHP of Greater Springfield has contributed $43 million to the local economy, supported 74 jobs and generated $51 million in first mortgages.

“We used to have to struggle to make the case that providing affordable housing has an overall impact on the community at large,” she says. “Now no one questions it.”

Written by Pam Bailey, communications writer for NeighborWorks America.

“Springfield is very segregated in terms of income,” explains Tina Koumoutsos, executive director of Neighborhood Housing Partnership (NHP) of Greater Springfield, which celebrated its 20th anniversary in 2013. “Most of the new development is on the north side, where the more affluent residents live. People in the southern neighborhoods don’t have as many options.”

NHP-GS is doing its part to change that, however. In 2011, it partnered with the City of Springfield to leverage funds from the second round of HUD’s Neighborhood Stabilization Program, created to assist communities whose viability is at risk in the wake of the wave of foreclosures. This funding, says Koumoutsos, was a “blessing. We had no debt to service, and could use the project instead to generate a revenue stream to invest back in our work.”

One year later, NHP offered 12 two-bedroom duplexes for rent, specifically for individuals age 55 or older who are making 50 percent of the area median income or less. In addition to reasonable rents, affordability is assured through green building practices that keep energy costs low.

“We designed these units with ‘smart growth’ in mind,” says Koumoutsos, who was the city’s housing coordinator before she became the founding director of NHP. “That means people and their special needs were our focus, not cars.”

For example, the new development was positioned to be “walkable,” with a YMCA, government offices and a performing arts center within easy reach. The property manager of the complex owns another, larger senior-service project and provides case-manager services to both developments, including recreational activities and transportation when needed.

|

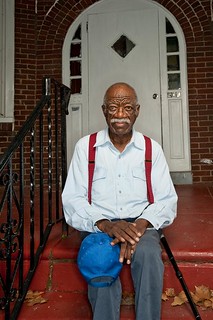

| Front porches (without steps, so people with disabilities can easily access them) are main features of the new walkable community for seniors. |

In addition, the development was built with a goal of “zero steps.” Koumoutsos explains that NHP wanted the residents to be able to safely age in place, as well as to welcome disabled friends and relatives. That means no stairs that could become wheelchair obstacles, as well as special touches such as walk-in showers in the bathrooms and accessible kitchen cabinets. At the same time, however, the NHP team worked hard to make the look inviting, rather than institutional, and the second bedroom in each unit offers plenty of space for visiting children and grandchildren.

“All of the units filled almost immediately, and we have a waiting list of about 100,” says Koumoutsos. “We are in discussions now with the city about building more, since we own the adjacent land.”

“Impact” is what Koumoutsos and her team strive for. A recent study documented that in the last five years, NHP of Greater Springfield has contributed $43 million to the local economy, supported 74 jobs and generated $51 million in first mortgages.

“We used to have to struggle to make the case that providing affordable housing has an overall impact on the community at large,” she says. “Now no one questions it.”

Written by Pam Bailey, communications writer for NeighborWorks America.